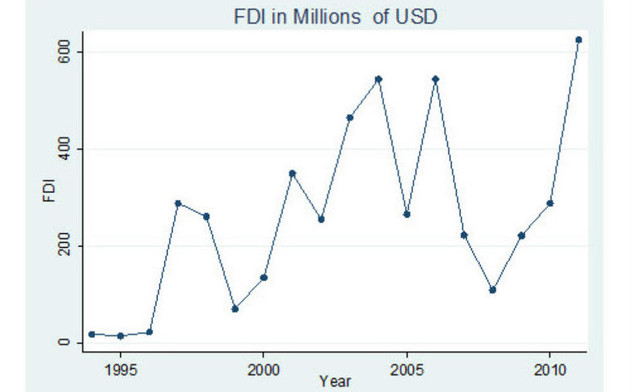

International Monetary Fund (IMF) graph illustrating Ethiopia's Foreign Direct Investment. (Source: IMF)

International Monetary Fund (IMF) graph illustrating Ethiopia's Foreign Direct Investment. (Source: IMF)

By Temesgen Deressa and Amadou Sy

July 2, 2014

Last month, Moody’s Investors Service assigned a debut sovereign rating of B1 to the government of Ethiopia. A B1 rating is equivalent to a B rating in Fitch Ratings’ scale, which is the agency that rates most African sovereigns. The rating puts Ethiopia on par with Rwanda but a notch below countries such as Kenya, Ghana and Zambia, all rated B+ by Fitch. Oil exporters such as Angola and Nigeria are rated better at BB-.

Moody’s Investors Service rating of B1 for Ethiopia is based on four main key drivers: (1) the country’s small economy and low per capita income, balanced by a track record of strong economic growth over the past decade; (2) weak institutional setups in comparison with B-rated countries; (3) moderate fiscal strength, with debt burden and related financing costs remaining low given a largely concessional funding base balanced by its increasing reliance on non-concessional financing; and (4) moderate susceptibility to event risk, which balances credit strength and credit constraints.

Read more at brookings.edu.

—

Related:

Ethiopia receives credit ratings needed for Eurobond issue (Reuters)

Join the conversation on Twitter and Facebook.